[VIDEO] Policy Stacking Using Asset Care from OneAmerica

Achieve target LTC protection by purchasing multiple policies over time

Clients in their 30s, 40s and early 50s are focused on saving for retirement and may miss out on the advantages of starting their long-term care (LTC) planning in those years. Putting off the purchase of protection until their 60s or beyond can be costly both in terms of premium dollars and the potential to become uninsurable.

A stacking strategy allows potential clients to:

- Benefit from lower premiums at earlier ages

- Lock in insurability

- Adjust when needs change

- Build up to a desired protection amount over time

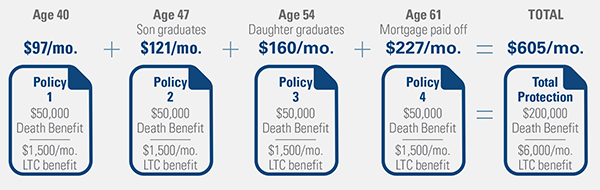

Case Design Option 1 using Stacking Strategy beginning in 40s

Tom and Anna (both 40 years old; married, non-smokers in good health) determine that even with their other expenses, they are able to allocate $125/mo. toward a LTC strategy. They purchase their first Asset Care policy at age 40, and then subsequent policies every seven years as their other expenses end. By age 61, for $605/mo., they have four Asset Care policies which will provide them $200,000 of life insurance protection AND $6,000/mo. each in long-term care protection for life.

Case Design Option 1 using Stacking Strategy beginning in 40s

Tom and Anna begin purchase long-term care protection near retirement, at age 61. For $874/mo., they purchase an Asset Care policy, which provides them $200,000 of life insurance protection, as well as $6,000/mo. each in long-term care protection for life.

Result

vs

By starting their Asset Care purchases early and “stacking” policies, Tom and Anna benefit from lower premiums AND achieve nearly $270/mo. in premium savings for the same life insurance protection and monthly long-term care benefit amount for each of their lifetimes.

Want more information? Watch this video to learn more about this sales strategy.